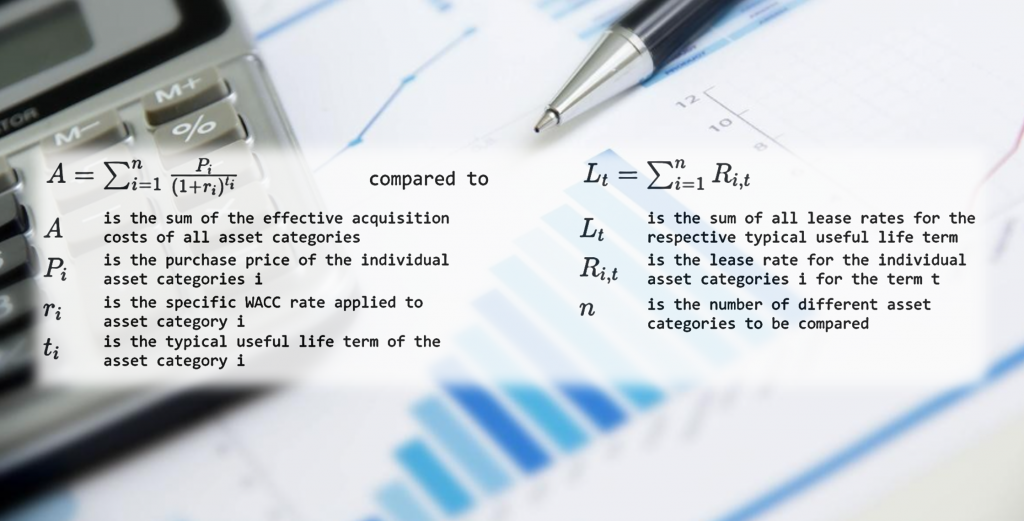

The comparison is made as follows:

In full sentences this means:

“Summed purchase prices of all assets, compounded with the selected/entered WACC interest rate in relation to the respective useful life period of the assets”

compared to

“Total lease payments which already include the debt capital market interest “

Why do we calculate like this?

To draw a really fair economic comparison between a one-time payment and ratable payments, then of course you have to compound the one-time payment with the interest rate of the capital origin used over the useful life of the investment.

An analogy from private everyday life*:

You have to buy a new car because your old one is no longer repairable and you depend on it for your work. You have decided on a vehicle with a purchase price of 20,000€.

You can take 10.000€ out of your saved money. However, you have invested this in a stock fund, which has yielded an average of 6% interest in the past. The remaining 10,000€ can be borrowed from your house bank at 5% interest.

Your average cost of capital is thus 5.5% p.a., since you forego 6% interest on your equity and have to pay 5% interest on the borrowed capital.

On the other hand, a company that specializes exclusively in car financing will offer you an interest rate of 4% for the entire acquisition costs. After all, this means that using your own liquidity would cost you more than using the car credit. So, how would you decide?

* This example is only intended to illustrate the principle of the comparison logic. Further aspects of leasing over conventional financing compared to self-provided cash have been omitted for reasons of simplicity.

Optional services

There are, of course, numerous optional services to be found on the market in addition to the pure financial product of leasing. The options available in the calculator are the ones most in demand, which is why they are also available for selection here – but only in terms of cost.

Despite the fact that these services are taken into account on the cost side (if selected), no process cost savings are deducted by the calculator on the lessee side, as many departments are unable to precisely quantify the costs that are eliminated.

Therefore, potential savings with leasing are considered conservative and as minimum savings.

Editor’s note

The lease rate factors used (per asset category and useful life) are based on current market conditions for digital workplace equipment from A-brand manufacturers, such as Dell, HP, Lenovo or Apple and for companies with a medium credit rating (B rating). To obtain a genuine leasing offer, it is best to speak directly to your responsible account manager.

You want to learn more?

What you should know about the Weighted Average Cost Of Capital